Introduction

RealtyDao is a Decentralized Holding and Development Platform for Digital Native Assets (DNA) on the blockchain.

RealtyDAO is unique with our ability to lean in to DEFI by leveraging the 20,000 premium and historical DNA like Referrals.com, Applications.com, eShares.com, and others. Utility drives Price and is one of the first steps to get aggressive and compounding value vertically and horizontally by leveraging key software tool sets within Assets.

RealtyDAO focus is to acquire/attract premium digital assets, cryptocurrency pledges, and build an all-digital network of streamlined assets and tools that compress time and increase value through utility and distribution synergies.

One core goal of RealtyDAO is building a sustainable network of relevant assets for the Appreciation of Time and Resources against other opportunities like ETC, BTC. Our circular and transparent structure gives our members confidence with their time while adding value to their investments.

With RealtyDao, you can

> Grow a pool of virtual real estate assets.

> Own a claim of premium RealtyDAO tokenized Digital Native Assets

> Send a proposal to add your DNA for tokenization and into our defi blockchain platform

Bringing premium Tokenized TLD assets to the digital market, RealtyDao is focused on helping increase asset values through:

1. Tokenization

2. Automation

3. Distribution

Classes of Digital Native Assets

RealtyDao has various Digital Native Assets or (DNA's) being rolling out including:

General Features of The RealtyDao Protocol

Create Liquidity For Your DNA's

Create liquidity for your non-liquid new TLDS or domain assets by means of tokenization on the Ethereum blockchain.

What is Asset Tokenization?

Asset tokenization refers to the act of turning the ownership of a real-world item into a digital token and in this case, we use our ESH protocol. This can be done in various ways, but all result in the legally-upheld bridge between the physical asset (real estate property, vehicle, gold, etc.) and its representative token. A token is a transferable unit of something. Deeds, titles, and certificates are all traditional versions of a “token,” a symbol or item that represents something else.

A deed to a house represents ownership of that house. “Token” is used to refer to the digitally native asset which represents the real-world asset itself. “Digitally native” refers to how the asset exclusively lives on the internet. Whereas traditional asset ownership like a deed, title, or certificate requires a piece of paper with legal approval, digitally native assets have ownership baked into the asset itself. “

Tokenizing Your DNA

When you suggest a DNA for marketplace inclusion, there are two things that will happen in the DAO governance.1. You instantly create liquidity for your DNA whether it's a new TLD by the Handshake protocol or a domain that you own, assuming RealtyDao accepts your asset and valuation.

2. Token holders can vote on proposals and acceptance.

Buy Tokenized DNA Tokens

Our growing RealtyDao community, you gain unique asset ESH tokens using our RDAO liquid backed token.

Increase Value to Assets Using our Programmatic Interaction Governance

Our VNOC Tokenization platform uses a programmatic interaction protocol that ultimately increases value of your ESH token over verified DNA transactions and interactions. This ESH token value will increase as time goes by with a 1-1 bonding curve. Get in early, have more voting weight in the future direction of RealtyDAO.

Voting rights for DNA Tokenization

Joining the RealtyDao community gives you rights to participate in community voting for DNA's that you want to tokenize, develop or liquidate . Perhaps you have an interest in owning a piece of this DNA but as of the moment, it was not tokenized by the owner. Participating in voting for the specific DNA will move it to the ranks of what asset will be tokenized first.

Participate in RDAO Liquidity Mining Program

RealtyDao has invoked a RDAO Liquidity Mining Program on specific DEFI platforms allowing to mine RDAO tokens by locking in USDT/ETH/DAI/BTC using your favorite wallet. Initial phase is using the upgraded MetaMask wallet with near future plans to incorporate other wallet solutions.

LOCK-UP PERIOD

Stakeholders will have a percentage of the pool and the equivalent RDAO tokens to use within the platform providing they will not trade their RDAO tokens anytime within the 1 year lock up period. RDAO has various lock up periods and spread out so liquidity market makers are in check with growth resource utilization.

Initially on UNISWAP with a RDAO/ETH, RDAO/BTC will move on to other platforms such as Balancer.

PROTOCOLS USED

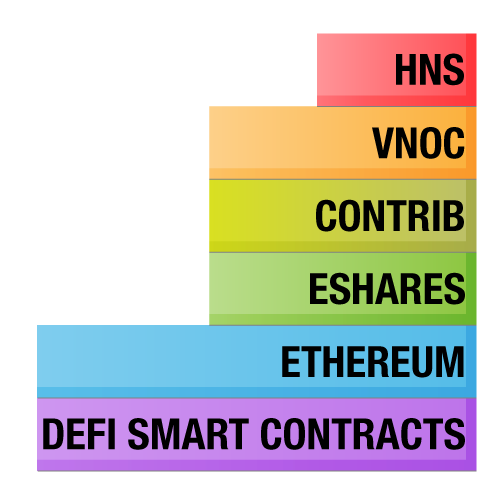

REALTYDAO Building Blocks

REALTYDAO is an aggregation of these smart protocols :

1. Eshares protocol

2. Handshake Blockchain

3. Ethereum Blockchain

4. Defi protocols

5. VNOC OS and CONTRIB Network

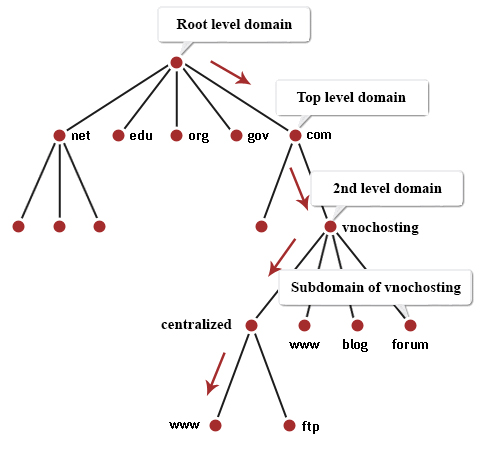

TLD

TLD

Top-level domains are at the highest level in the hierarchical Domain Name System of the Internet. The top-level domain names are installed in the root zone of the name space.

Sample of a tld is com/, net/

HANDSHAKE BLOCKCHAIN - THE NEW TLD NAMING PROTOCOL

Handshake is a UTXO-based blockchain protocol which manages the registration, renewal and transfer of DNS top-level domains (TLDs). HANDSHAKE'S naming protocol differs from its predecessors in that it has no concept of namespacing or subdomains at the consensus layer. Its purpose is not to replace DNS, but to replace the root zone file and the root servers.

DNS hierarchy

The aim of the first section is to help you familiarize yourself with the DNS hierarchy. This will help in understanding how Handshake works.

Handshake is the only protocol that works to replace the ICANN root server. By doing this, the resolvers point to an authoritative name server configured to the blockchain rather than ICANN’s root zone file. This enables Handshake to issue new TLDs that live on top of existing DNS. Any owner of Handshake domain names gets a cryptographic key which provides the owner the ability to create signatures signed by the owner’s key. This creates a trustless system that does not rely on Certificate Authorities, minimizing the risk of bad actors creating redirects, phishing attacks and spying on your traffic.

blob:https://teams.microsoft.com/9505438a-3b9a-4e30-9b24-ddbad9d736bc

With the Handshake protocol, you can now create your own .tld in it the auction marketplace for HNS tokens.

The new internet is now allowing you to buy/own for eg. myname/ cherrytops/

ESHARES PROTOCOL

ESHARES PROTOCOL

eShares.com is an integrated and semi-automated stake table management system for digital assets. The flexible and secure application is a simple and effective feature managing some of the worlds best digital assets including Handyman.com, Mergers.com, Staffing.com and others. Integrated into the VNOC tech stack and Contrib network, eShares focuses on managing individual and performance based value creation, contractual agreements and compensation for over 20,000 assets.

The concept of programmable money and programmable equity together push us into a world where unprecedented value can be created by autonomous value-creating networks, managed by eShares.com.

The Implementations of ESH within the network allows for easy and instantaneous share computation for each contribution to a digital asset.

Each RealtyDAO that is brought into the marketplace will have its own ESH value which depends on it’s assumed Theoretical Value, (TV ) thereby measuring the claim you have on the asset.

Theoretical Value (TV) is calculated using the following DNA criteria :

1. Price value

2. Vote value

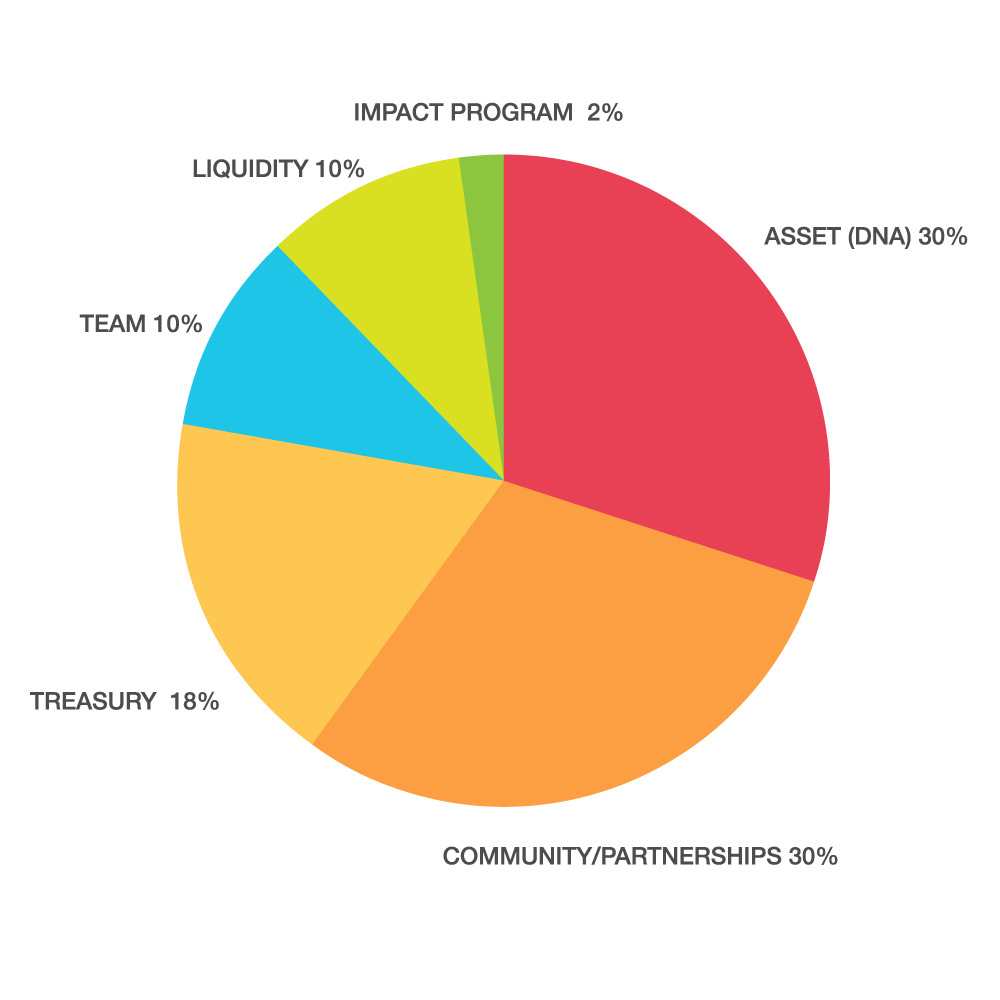

The ESH PIE

Default Pie breakdown for each DNA. All assets when tokenized in our platform will automatically have these assigned ESH tokens which the owner can still move to his desire. But for the sake of simplicity, we have created these as default.

1. Asset (DNA) = 30%

2. Community/Partnerships = 30%

3. Treasury = 18%

4. Team = 10%

5. Liquidity = 10%

6. Impact Program = 2%

THE RDAO TOKEN

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. As stated by William Mougayar, “A unit of value that an organization creates to self-govern its business model, and empower its users to interact with its products, while facilitating the distribution and sharing of rewards and benefits to all of its stakeholders.”

RDAO Token is a flexible ERC protocol using the EVM blockchain to build programmable logic and rules into the digital network of asset.

Without RDAO you cannot participate inside RDAO. RDAO and the foundation will use operating profits and repurchase RDAO tokens on the open market and on current market pricing. This means there is no chance of a profit for many years.

Please read our terms and agree with the full understanding that RDAO tokens being offered are access and utility tokens to the network and should not be earned or acquired with the intention of redistribution outside the network.

THE RDAO TOKEN ALLOCATION & APPRECIATION ALGORITHM

- 1 Billion RDAO TOKENS was minted on the Ethereum blockchain on October 08, 2020.

- Initial USDT value of 1 RDAO token = .022 USDC ($2.2M valuation)

- LIQUIDITY CAP : 300,000,000 RDAO tokens

- TREASURY CAP : 180,000,000 RDAO tokens

RDAO Appreciation mechanism is the model in which the RDAO value increases as RDAO assets are created and added.

GOVERNANCE

Exit to Community model with gradual/hard decentralization plan. RealtyDAO is progressively moving to decentralize and is currently in its test phase using VNOC DAO Manager. RealtyDAO members are required to hold a min of 100,000 RDAO to participate in REALTYDAO governance.

RDAO LIQUIDITY MINING PROGRAM

In order to incentivize the growth of the RDAO, the community has launched a liquidity mining program. In the program, owners can stake TLD’s in order to earn more RDAO.

The first 12 months the liquidity mining program is offering a percentage of the RDAO liquidity cap per month that will be distributed among stakers, Contributors and liquidity providers.

RDAO community

REALTYDAO controls all HANDSHAKE TLDS in the platform, currently, and 10% of the premium .com digital assets included in the initial portfolio.

RoadMap

BUILD BETA 1

- Develop DAO governance within the DAO code structure

- Streamline Token Transfers among assets

- Create the multi protocol platform

- Integrations of permissionless token exchanges

- Liquidity Mining Program on Uniswap and Balancer

- DEX Listings

BETA 2 (Dec. - March.2021)

- Adding Class Liquidity Pools

- Security Vaults for HNS TLDS

- Multi-Chain operability

- DNA Asset Trading